What Entrepreneurs Need to Know About Raising Capital Today

Because of the low yield today in bonds and other investment classes, and competition for deals, valuations of early-stage ventures have been creeping up.

Many would say that is long overdue, but investors need compensation for the high risk of these ventures too. And frankly almost no one can pick mostly winners due to the many inherent unknowns at the early stage of any venture.

This article is an introduction to the financing of any early-stage company across the stages from seed to Series B. The financing landscape today has changed radically with many more options. Some financing is easier to get but generally, equity financing is hard to get for most companies without a revenue history. Everything you learned about this topic in the last ten years, or that the press printed more than one or two years ago, may now be obsolete.

Sure, there are unicorns and $10M+ investment every day, but there are about 5,000,000 new companies formed every year in the U.S. alone too. The companies and teams getting this level of money often have a long track record of successful returns to investors. Or they have a proven cash-flow, or at least quantified their customer acquisition costs, margins and likely a huge market opportunity too. They are also most likely articulating a great market entry strategy (3-steps usually). Valuations are good for these companies, sometimes 10 to 20X revenue. Which is a new high for such young companies and based on very rapid growth expectations.

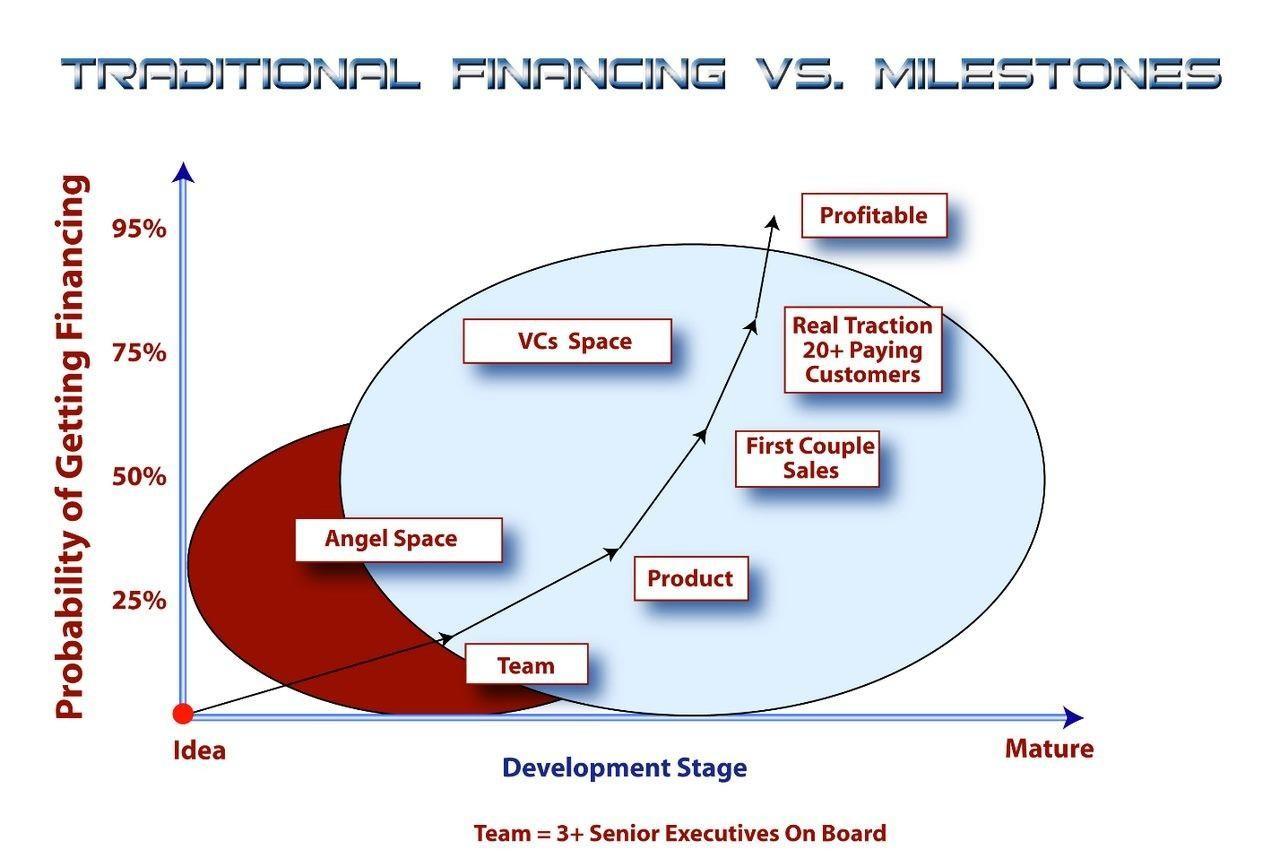

We are back to looking like the early 1990s again as everyone has "moved up the food chain" one to two levels. Seed money is always the hardest to raise, because the risk is highest and the reward needs to be high too. This happens in difficult economic times and recessions when “Cash is king” and investors can be very choosy and demand better terms than they might deserve. True Series A financing, historically funding designed to develop the prototype or product, are rare today. The vast majority of all institutional investments are in companies with proven "traction", this means lots of sales completed and cash-flow. Hence, lower risk. However, the yields they demand and expect are usually not any lower. Making institutional venture capital unattractive for most, and unattainable for most too. The biggest mistake you can make is saying "They did it so we can too" if your team is not all A players with 15 to 20 years successful experience. This is maybe a few percent of you.

In the early days of venture capital, there were usually two rounds of financing before this “expansion” capital was raised. One round was to develop the product and another to accomplish the first marketing and sales (“traction”) by testing the sales and marketing processes. Some companies even raised $500K to explore the business opportunity for months before these, though typically that would go to highly experienced Entrepreneurs who had a previous exit and record of accomplishment with investors.

Extract from Entrepreneur Magazine:

According to data compiled by Fundable, only 0.91 percent of start-ups are funded by angel investors,

while a measly 0.05 percent are funded by VCs. In contrast, 57 percent of start-ups are funded by

personal loans and credit, while 38 percent receive funding from family and friends.

So, despite the daily headlines about venture capital investments your chances are about one in two-thousand of ever getting a VC round closed for your company! However, I can teach you to position your company for that later and find the right investors for you given your circumstances today. Today you need to get much further along on much less money. This can be easy with an app or software company where sweat equity can build the entire product. However, if you need some capital to build something, rent space, test marketing, ant other things you will likely need an angel investor or a few. However, this is not all bad. Generally, that means bootstrapping, or lean startup methodologies are always best in the first year of any company. This preserves equity for Founders, creates a basis for some valuation (an idea alone is worthless, literally) and give you opportunity to validate the product/service need and the best market. Some might spend 90 days on that, other a full year. Less is probably a big mistake. and both cash and equity from the Founders to support the first year or more of business development.

Many see this as the highest risk period, as we know the least, but the flip side of that coin is your cash burn rate can be near zero and the opportunity to design a successful business is completely open and flexible. You have no inertia, costs or legacy to hold you back from disrupting an industry. You can pivot on a dime without rebuilding anything. Magic happens in the design process always. And inexperienced founders do not approach the "Business Model Design" as an art and process. It certainly is both. The ability to iterate and test ideas (product, target market, pricing, best customer archetype, etc.) allows you to learn and build without lots of risk or capital. Hence, the argument can be made that it is the least risky time too.

One approach to this phase of business design and market research is adding a service component to your market entry strategy which allows you to sell services to fund the company and learn about the market. I call this a “Service to Product Flip” strategy. Entrepreneurs should always prefer a product company to a service company for many reasons, but mostly because products are more scalable and can have higher margins. Also, a service business is generally easier for competitors to replicate, meaning fewer barriers to entry and pricing power. However, there is a third option which is a hybrid of a product and service that has attributes of both. This allows direct, high bandwidth learning with your best prospects and customers while you develop your product. And gives you some revenue to extend your runway, maybe even to infinity.

Another strategy is to work with corporate partners who may have a high pain around the problem you intend to solve. Ideally, if you can get a company to pay for you to build something they need and retain the rights to the intellectual property, maybe giving them some discount or even a piece of your business for that in exchange, you not only get funding, but you also get to work closely with a customer who is very serious about the solution for the target problem. Essentially this is what Bill Gates did when he sold an operating system he did not yet have (and later bought from Seattle Computing) to IBM to create the first IBM-PC computer. He retained the rights to sell that O/S to others. Bill may not be the billionaire he is today without that savvy deal. An IBM regrated this later for sure.

Bootstrapping can take many other forms from a full-time job to contracting or a partnership trading some exclusive first rights for some funding. But be careful to protect what you develop by not building it on an employer's site or computers. And not having an all-encompassing employment agreement that gives them rights to anything you develop.

Unfortunately, over 85% of Entrepreneurs will still fail to build a successful company that can survive. This is usually due to a lack of experience, overconfidence, and not understanding all the skills and experience needed to launch a company. And often greatly underestimating the time and capital needed. If it was easy everyone would do it.

Interestingly even companies that get five million or more in venture capital funding will have about an 80% failure rate. What this means is venture capital partners are not that good at picking companies. It also strongly implies that lots of money does not even impact success rates that significantly. Lots of money can even be a hindrance to success by building infrastructure and expenses before proof-of-concept is achieved. And it gets harder to pivot when you build infrastructure. Staying agile is critical as a startup and small company. It is the only advantage you have over the big companies sometimes. And by distracting the team from a focus on figuring out the product-market fit as the first objective.

Achieving each of the milestones shown above will dramatically increase your chances of finding investors. And yes 0% is the chance of getting financing with just an idea, though the naive media promotes the false notion that an idea is all you need constantly. More on this later.

The above slide is just one of over three hundred slides in our financing courses which are part of The CEO and Entrepreneur Boot Camp. There we discuss over thirty sources of capital and teach you everything you need to guarantee you will get funding.

Now I am not trying to discourage anyone from starting a company. In fact, I know that Entrepreneurs are the backbone of job creation, innovation, and even the global competitiveness of the United States. However, knowing how hard this mountain is to climb allows you to properly prepare and budget time and money. And to take the time upfront to design the proper business model for your value proposition. These are two things that will significantly increase your odds of success.

To learn more, click here

Most Entrepreneurs also fail to find the best target market. This means subdividing larger markets into niches and determining where the pain is highest and the price sensitivity, and ability to pay, are best. start-ups want a small market, not a large one. They do not want to either attract the attention of large companies or have to spend large sums of money marketing while validating their value proposition, pricing, sales strategy and messaging. We Entrepreneurs almost always think our offering is good for everyone. Few are and counter-intuitively a smaller market for launch is better. It allows focus on the best prospects and reduced sales and marketing expenses.

|

Learn more about our Growth and Scaling (GSP) |

|

For a free video consultation call on what your |

Entrepreneurs should typically spend at least a few months of full-time work to find the best market, do competitive intelligence, and iteratively learn by interacting with prospective customers. This is critical to validate the market need. I love to say to my employees “What we think does not matter. It is what the prospect thinks.” Any amount of intellectual analysis only gets you closer, it never completely validates a market need. It is theoretical, not a real-world test.

Many top Entrepreneurs will plan on as much as a year for this business design and development process. And yet most new and first-time Entrepreneurs spend a fraction of the time they should on these activities that are the best way to ensure success. They think just because they “want” something, the customers will too. Hence, huge failure rates launching new companies and products. Many think they can even raise funding with just an “idea”. This is totally nuts actually. See my other article on that misconception here.

For a complete tour to prepare you for starting any company or launching any new product check out this roadmap to success: The Entrepreneur’s Journey.

A real financing strategy maps out three to five years of financing in a plan showing major milestone achievements, and how these will increase the valuation of the company and make the further rounds all easier. This is built into a 5-year simulator spreadsheet. Not just a pro forma that most accounting people do for running what-if scenarios and tuning your capital raising plans.

Click Here to Learn About The CEO & Entrepreneur Boot Camp.

We believe this is now, as of 2021, the best training on the planet for CEOs and Entrepreneurs.

Join the course How to Raise Millions from Outside Investors

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has trained, coached and advised over 1,000 CEOs since 2002. And is Founder of The CEO Boot Camp™ and Entrepreneurship University™. Mr. Norton works with companies to triple their chances of success in launching new companies and products. And helps established companies scale faster using the six AirTight Management™ systems. And helps companies successfully raise capital.

What can we help you with today? Scaling, training, consulting, coaching?

Call (619) SCALE06 or (619) 722-5306 9am-6pm CT

Or Schedule a free 30-minute strategy session by clicking here.