How Long Does It Take to Raise Venture Capital Typically?

Learning and preparation should start at least a year in advance. Once you are prepared, allow six months. It could be shorter or longer, that will depend on your deal and the market at the time in that industry space. Hot deal areas can get done quickly, most will be several months at least.

Click here to get this Financial Package

Pitching and corralling investors with interest is not in your control. I can take three to six months. Often the partners become unavailable (on their yachts and at vacation homes, presumably) for summer and winter holidays.

| Learn more about our Growth and Scaling (GSP) |

| For a free video consultation call on what your |

Nothing you can do because usually a partner meeting and vote is required to finalize any deal. Due diligence can take sixty days. Generating a sense of urgency is always a challenge as they have a hundred deals they can do every...

How Does An Outside Investor Determine Pre Money Valuation?

| Learn more about our Growth and Scaling (GSP) |

| For a free video consultation call on what your |

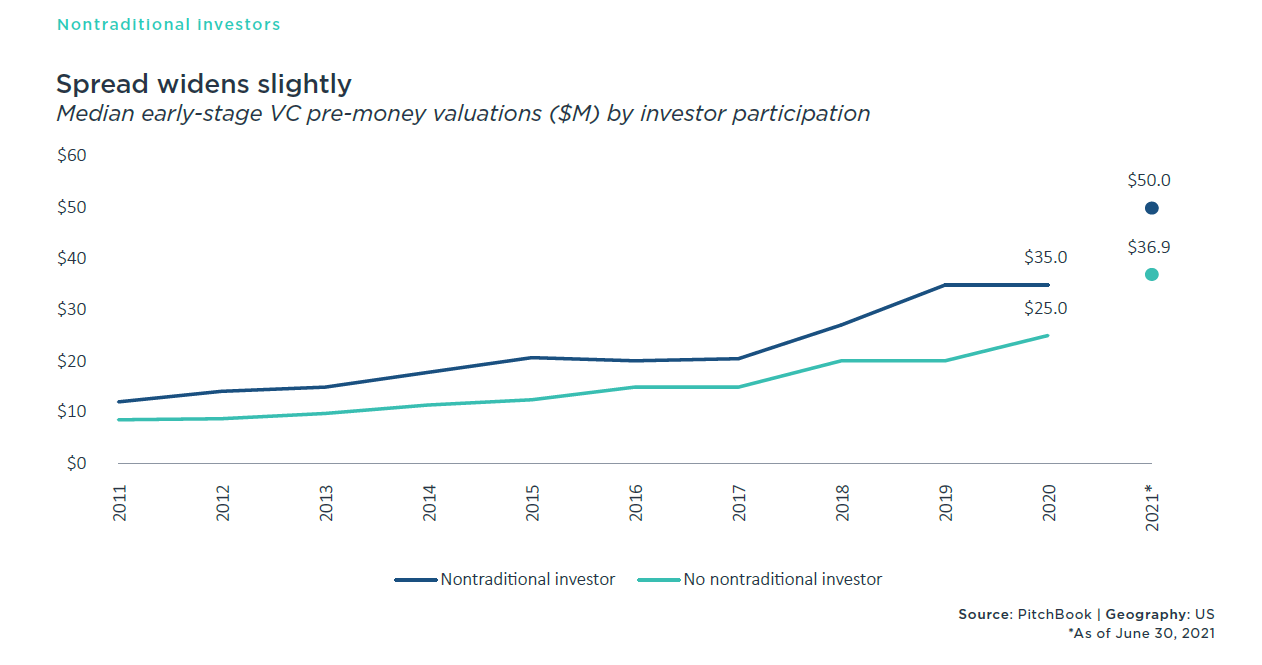

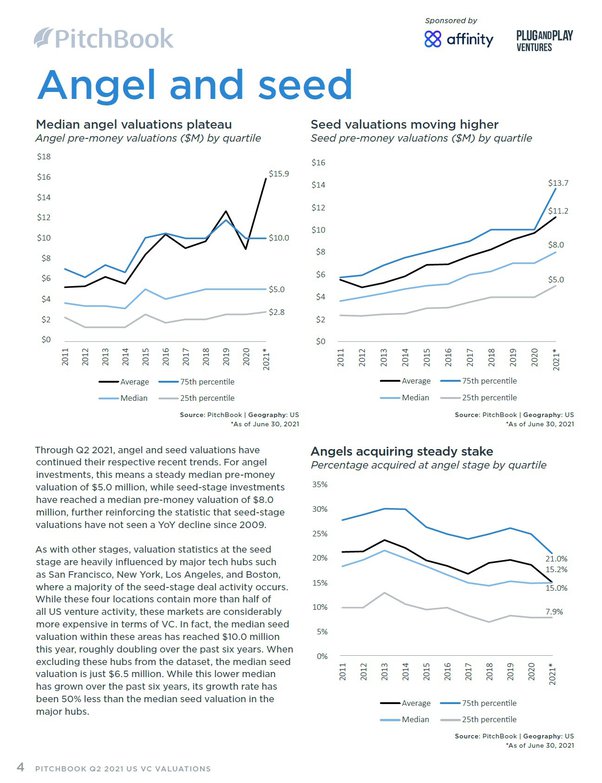

Here is a graph showing the deals reported to Pitch deck, which could easily be skewed very high by all the smaller deals that go unreported

Click here to get this Financial Package

To get entrepreneurship tips, check out Bob's Blog

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has trained, coached and advised over 1,000 CEOs since 2002. And is Founder of The CEO Boot Camp™ and Entrepreneurship University™. Mr. Norton works with companies to triple their chances of success in launching new companies and products. And helps established companies scale faster using the six AirTight Management™ systems. And helps companies successfully raise capital.

Call (619) SCALE06 or email...

How Do I Find an Approach Angel Investors?

Networking is the key strategy. You need to get out there and meet other CEOs, investors and key referral sources at physical events. LinkedIn can be a way to find them, but cold approaches are difficult. I get invitations to invest every week from people I do not know, and I am certain most are not high-quality deals within seconds from their email, deck or type of approach. Bad English, missing key data, no team background and a hundred other red flags mean an instant rejection. Too many to even send five minutes looking at them when the CEO cannot hit the key points to sell the deal in a few sentences. That is the only thing that will get me to read a deck, unless I want to sell them the help they need to raise funds because I like their idea and think the CEO/Founder has potential.

Click here to get this Financial Package

Warm interdiction are best. This is best if it is a CEO that made an investor money, introducing you to their past investors. Lawyer, accountants and...

How is it Possible that A Startup Company Can Raise A $100 Million Dollars Or More?

The more money that is poured into a deal, the lower the risk and more market share they are likely to garner. And hot deals where growth and financial projections are getting real can create a feeding frenzy among investors. It is also likely that these larger investment can scare off smaller competitors. It is often assumed there are a limited number of winners in any given market.

Click here to get this Financial Package

Furthermore, it could be three or ten, but limited. Therefore, more money means lower risk and higher upside. Sometimes these deal with blow up, proving to have false expectations. WeWork was a good example of this, and so was Theranos. Both we run by entrepreneurs with questionable ethics. And that’s why the most good investors will want to see strong integrity in the CEO and management team. No one wants to invest in a company with a dishonest management team.

Join the Free Webinar: Mastering the Top 10 Challenges of Growth & Scaling

Bob...

What Kind of Return Do Investors Expect When They Invest In A Startup or Small Company for The Long Term?

They say venture capitalist would like a 40% IRR which is an approximation of their ROI, but this is all fantasy based on assumptions that drive the financial projections. Pessimistic projections can be used to negotiate lower pre-money valuation prices. So the CEO/Founders are selling the potential while the investors are selling the downside risks.

Angel investors would like to see good returns like this too, but are unlikely to develop their own models to their own assumptions as the amount of work involve is large, and they have no associates to do that work. Angel syndicates on $1M+ deals might do this work though and use their results to negotiate equity prices.

Click here to get this Financial Package

The reality is few deals ever perform anywhere near their projections as there are too many unknowns that early on to have any confidence. The numbers will be rerun every time there is a learning experience and could go up or down dramatically. Angels are protected...

What Kind of Terms are Reasonable to Provide Angels and Venture Capitalists?

This is a big question and the deviation is very large depending on many circumstances. However, I will give some baseline information to help you prepare for the negotiation of terms. Your mileage will certainly vary.

Angel investors, early on, will not get anything except a promise of equity later via a convertible note or SAFE note. Their ownership stake is too small to have any real control, and the legal structure of a note gives them no real voting authority at annual stockholder meetings. So, control is usually not a big issue unless an investor is large enough to request certain covenants or guarantees. Giving out any rights at this stage can cripple a company to get the next deal done, so it is advisable to have a clean and simple note without any special privileges except the conversion discount. This might be warranted with a $250K plus investment. In this case the investor may want a board seat, board observation seat (non-voting member) or a special discount on...

How do I know I'm ready to approach outside investors to raise capital?

Well, this is art more than science, so you will need an expert in raising capital to review the materials you have prepared and tell you your materials are of sufficient quality. These materials should include the following, even at the seed stage, even though the bar for quality and completeness will not be as high:

- Pitch deck

- Business plan with market research, competitive intelligence and the business model you have designed to be unique in the marketplace

- Team resumes in detail with every job (no holes)

- Financial projections

- Product offering and any sales and marketing results that can drive the projections. This includes Customer acquisition costs *CAC) and lifetime value (LTV) of a customer.

| Learn more about our Growth and Scaling (GSP) |

| For a free video consultation call on what your |

If you do not have quality versions of all these things, you are not ready to...

What kind of business plan do I need to attract outside investors?

Typically, you need a 20 to 40-page plan that discussed each of the five key areas of the business, which are marketing, sales, product development, finance and operations (delivery). You will need this read by an objective and experienced expert for feedback. It is highly likely that you are both too close and not experienced enough (as an investor) to know how good the quality of this plan can be ranked.

| Learn more about our Growth and Scaling (GSP) |

| For a free video consultation call on what your |

See links to other blog postings that list more detail on what is needed to approach outside investors. Most people blow the opportunities by approaching the contacts before they are properly prepared.

How to Raise Millions for Any Company - Online Video Course

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has...

How Do You Go About Finding Outside Investors and What Does It Take?

Networking is always the best method to build your universe of contacts. Historically this was done by attending investor pitches, meeting other CEOs and Founders and working with consultants to target specific categories and profiles of investor. However, with COVID and more technology and social networks there is an increase in cold outreach through platforms like LinkedIn, Angel.co, angel syndicates and other platforms that allow you to publish your profile. Of course, crowdfunding is also a way to find angels, as these platforms have member that are active and want to invest small amounts in many deals. This however a very different strategy with a different marketing and sales plan than approaching traditional angels and VCs.

One key strategy is to back trace investors who made money in the sector before from SEC filings on IPOs. This can point you to individual investors as well as venture capitalists and even corporate investors.

How big are typical venture capital investment valuations at each stage of development?? Series A, Series B, and Series C?

This is best answered by this diagram of statistical information. However, be aware these are the deals that report only and not all deals and so likely higher than the true averages because smaller angel deals are less likely to report to PitchBook.

| Learn more about our Growth and Scaling (GSP) |

| For a free video consultation call on what your |

No one really knows or can get data on all deals as they are private and may be between the company and on angel investor.

I would guess these valuations are doubled by missing so many of the smaller, seed deals that go unreported. Many companies start with a single $50K to $100K angel which is enough to get a product finished after the founder’s invest sweat equity and some of their own capital while bootstrapping.

Click here to get this Financial Package

How to Raise Millions for Any Company - Online Video Course

Bob Norton is...