Planning for Higher Sustainable Competitive Advantage (SCA)

I find that pitch decks to investors fail to articulate how they will maintain a market lead and build barriers to entry around their business over time, as more competitors emerge. We teach 17 ways to increase SCA at The CEO Boot Camp and in our scaling consulting work.

I would recommend adding two additional slides to the standard 10-12 most have in their decks. This will impress investors far more than some fancy graphics or massive TAM market claims. Slides to add:

- Sustainable Competitive Advantage (SCA) - How will you evolve your barriers to entry over time. The "Moat" which can create higher PE ratios. Product roadmap and innovation? IP? Brand? Partnerships? Etc.

- Market entry strategy, which is not the same as Go to Market strategy. This shows expanding markets, niches and the $1B market opportunity - which NO startup should ever enter initially because then they are competing with giants on day #1. A slow suicide strategy.

These two additional slides...

What are Some Ways for Startups to Invest in Marketing with Little Cash?

You cannot grow a company without some investment in sales and/or marketing. The question is really your time versus capital and which would generate the best results (ROI, speed, quality of leads, etc.). If your business model and products are sound, you should likely raise some capital, as it will be needed for more than marketing. It is nearly impossible to build a significant business without some capital and/or sweat equity invested. You cannot create something out of nothing.

Social media allows unpaid marketing and is the most obvious strategy. This can be time-consuming but is also rapid to measure and so can be used to test the messaging and refine it quickly.

The more unique your product or service, the smaller the marketing budget you will need. For example, Tesla spends extremely little compared to other automakers on both marketing and sales. Word of mouth does it for you when you have strong and unique products. “Differentiation”...

Do All Startups Bleed Money and Does Scaling Always Require Outside Investors?

This was a question from a prospective Entrepreneur. Maybe one that believes that he/she can create a company without any outside investors.

Well, whenever you use the word “All” in a sentence you are almost always wrong, but it is true that the vast majority of startups and any company wishing to grow rapidly (scale) will require either outside investors, founder capital investment and/or sweat equity (founders working long-term for only equity).

This is because you cannot create something out of nothing. Like in physics, matter cannot be created or destroyed, it only changes form. Cash investment must be converted into value in the form of a product or service people will pay for, and the must be willing to pay more than the cost to deliver it. Generating a "Gross margin". Usually this needs to be 50% or more to pay staff and other overhead costs, though high-volume stores like groceries often operate on 20% gross margin.

First, let’s...

Scale Sooner and Perform Better - AirTight Management An interview with Go Solo

Scale Sooner and Perform Better - AirTight Management

An interview with Go Solo

This interview speaks to what is needed is to begin scaling and targeting companies that have some product market fit and are ready to begin growing.

What's your business, and who are your customers?

We help businesses with 5 to 200 employees scale their business by installing all the systems needed for strategy, management, metrics, process improvement, budgeting, and human capital.

Tell us about yourself Bob

As a serial entrepreneur for 14 years, I built and sold four different companies, returning 25x ROI to my investors and over $1 billion in profits.

What's your biggest accomplishment as a business owner?

Disrupting the real estate industry by creating the first high-definition, remote touring for residential real estate. Also disrupted financial services with five different products and created The CEO Boot Camp (2004), where we have trained thousands of CEOs and entrepreneurs in best...

How can a company plan to maximize growth?

Contrary to popular belief, growth is not just limited by your ability to increase sales. It is almost always capped by many other things like management quality, financing, operations, training systems, hiring and other systematization. Many companies have gone bankrupt by simply increasing sales. When this happens without getting ahead of problems with customer service, production, working capital and financial controls, companies can not just ruin their reputations and spiral down but even go bankrupt.

If you are lucky or smart enough to have a product or service with a large market opportunity, your company’s growth will be mainly limited by your ability to hire and keep top people, especially managers. Building a high-performance and innovative culture is usually key to growth. This means having a vision of the future and solving big problems for people. And giving your employees good reason to care about their job and work too. Simon Sinek’s...

What is a good growth rate to plan for in a small company?

I believe a minimum of 25% should be planned for in growth as anything less will likely leave you behind competitors and being a follower, not a leader in the marketplace. I consider “Scaling” to be growth of 50% or more annually. That is far more difficult and requires a quality management team, strong internal processes (systematization) and likely some capital investment in addition to cash-flow.

If you can reinvest your cash-flow and/or get some low-cost debt, which usually requires at least eighteen months of profitability, you can maintain control and avoid the time and complications of raising outside capital. If your market opportunity has a limited time window, you would probably be better off raising some capital and growing faster.

You may also be able to create growth by getting better payment terms with vendors who may have a much lower cost of capital than you and wish to see you succeed, so you can increase purchases from them too. As a company...

What is the difference between growth and scaling?

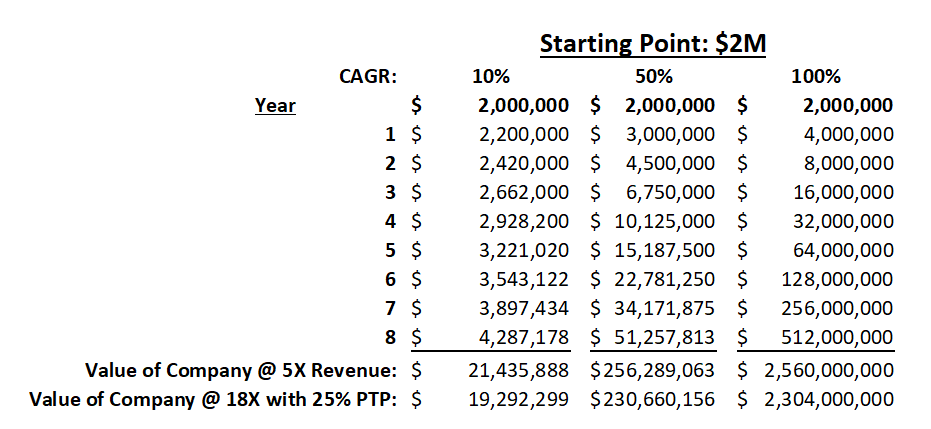

Well, although this is not officially defined by anyone, growth is literally any growth at all. We define scaling as the kind of growth that venture capitalists seek for high returns on their investments, which means fifty-percent compound annual growth rate (CAGR). Typically, the math of this, which is reaching $100 million in sales in about five years, means a company will need at least 50% annual growth, and maybe 100%. Here is a table that shows this kind of growth and reveals that massive compounding factor of this kind of growth. And explains why venture capital must seek large opportunities to pay high yields on capital invested, which can only come from strong growth.

What this math says clearly is that a company that grows at 100% per year will be worth one hundred and twenty-one times more than a company that grows at 10% per year after eight years. This is what creates real wealth when compounded, and what venture capitalists seek. The truth is even...

Do you need capital to scale or grow a company?

The vast majority of companies will need outside capital to grow at more than twenty percent or so compound annual growth rate (CAGR). This can vary a lot by industry, sales cycle, margins and other cash-flow factors. Some industries are more capital intensive, requiring upfront investment in plants, equipment, people, research and development or other things. However, generally if you plan to grow a company over $1M in sales, you will need a working capital financing strategy projecting these needs over three or more years.

We define scaling as over fifty-percent growth. So, unless your gross profit margins are exceptional, and your sales cycle and costs are very low, you will likely need outside investors to grow this rapidly. You can always choose to grow more slowly at whatever rate your cash-flow can support, but that may cause you to lose potential market share, especially early in a markets' life. Or you can seek some debt financing which will require...

How many managers are needed if you want a company to grow smoothly?

There is a ratio called span of control that says the most people directly reporting to a single manager should be seven. This can vary some based on the people, management systems and other factors, but it generally applies in most areas of a company. More direct reports means the manager will have little time for other work and activities like planning, strategy, communications with outside vendors, etc. Of course, not every manager has seven employees. Some may have only one or two. I usually differentiate this novice as a “supervisor” not a manager. They oversee an employee or two but may not have the harder management responsibilities like planning, hiring and interfacing with other departments. They are really a manger trainee but often giving the title of manager even though they lack the skills needed.

| Learn more about our Growth and Scaling (GSP) |

| For a free video consultation call on what... |

What must change in a company as it grows to reach larger scale?

This is a complex question, as there are many things that must evolve with growth. We break this down into the four “gear shifts” to get through the five stages of growth shown in the image below.

The numbers above are just an approximation and can vary widely by industry and company, but are guidelines.

Each stage requires very different management style, level of planning, people and risk management. These changes must be done, or the company will go sideways or fail. And often means giving up previous lessons learned and habits in the new stage.

Raw Startups require speed, high risk and micromanagement while the product market fit is figured out. Flexibility and agility are key, and easy to do with a small organization. Fast decisions, cheap testing and rapid feedback are required as cash-flow is likely negative and time is your enemy. The key goal is building the product and making sure it is valuable to the initial target market.

When the ...