Do All Startups Bleed Money and Does Scaling Always Require Outside Investors?

This was a question from a prospective Entrepreneur. Maybe one that believes that he/she can create a company without any outside investors.

Well, whenever you use the word “All” in a sentence you are almost always wrong, but it is true that the vast majority of startups and any company wishing to grow rapidly (scale) will require either outside investors, founder capital investment and/or sweat equity (founders working long-term for only equity).

This is because you cannot create something out of nothing. Like in physics, matter cannot be created or destroyed, it only changes form. Cash investment must be converted into value in the form of a product or service people will pay for, and the must be willing to pay more than the cost to deliver it. Generating a "Gross margin". Usually this needs to be 50% or more to pay staff and other overhead costs, though high-volume stores like groceries often operate on 20% gross margin.

First, let’s define a “Startup” as this is a wildly misused term with many subjective definitions. I am not including solopreneurs with service businesses who are simply freelancers or contractors selling their time. Usually, they can start a "company" with little or no capital, working out of their home. However, they generally cannot scale since they will have thousands of competitors and little or no differentiation. In general, services businesses are easier to start and grow without a lot of capital because you hire people “Just in time” when you have the work sold, and you are not developing a product over an extended period before getting sales that requires time and money. You also need little infrastructure and overhead, especially with virtual employees or contractors.

In my view, a true startup is a company that is doing something brand new, has near zero revenue. This is the old definition, today a "Startups" can have tens of millions in sales but still be unprofitable. A real startup must build a product and/or service that is new. This means lots of risk because they are not copying someone who has proven the same things works before. That “differentiation” is what creates their competitive advantage and opportunity for rapid growth. They are selling something you cannot get somewhere else. And as a result, they can have higher gross margins, too. This is what makes a company able to attract investment capital. Without differentiation, you will have great difficulty getting any investors except mom and dad.

You need to think about "Exit Value" years in advance, as investors do. To get smart investors, this differentiation must be "sustainable" over five or more years, too. It may be replaced with other things over time, but equity investors want to cash out in five years ideally. To have a good ROI, the company must continue that strong gross margin (differentiation) and also have some sustainable "barriers to entry". See my courses on intellectual property, strategy and innovation here to design a company with these advantages. Without these barriers to entry you will have many competitors making both growth and strong margins very difficult, or even impossible. The opportunity for strong growth (25% to 100% CAGR) multiplies the sales price of the company's shares and can mean a multiple of profits (or revenue) for the company that is double, triple or even ten times as high as other companies in the industry. Today as I author this article, Tesla trades at 47.75 times their price to earnings (P/E) with about a 40% growth rate and loads of differentiators and other operational advantages in the EV auto industry. While General Motors, Ford and Chevy shares sell at 6X, -24X and 5X. And all three legacy auto companies have tiny or negative growth rates. Tesla has a dozen sustainable competitive advantages it has built over the last ten years including vertical integration, no dealer network, little marketing cost (a function of unique products) and manufacturing that is far more efficient.

Even a franchise or copy of an already proven business model will likely require some capital. Even starting a fast-food franchise can easily cost $500K in startup capital. This may be best for people who do not already have ten or more years of business experience and have developed many business skills. Experience greatly lowers the risk. And franchises can flip the risk from an 80% failure rate to 20% or less because you have a proven formula, brand and help to learn and launch. Contrary to popular belief, most successful founders are over forty years old, though the press will love to write about the younger ones. The fact is, all of them get serious professional help. None survive without some senior staff help on the payroll as employees or consultants, or fractional executives.

It is almost always true that scaling (25% to 100%+ Compound Annual Growth Rate) requires outside investors, unless the founder is already wealthy and invests the startup capital themselves. Elon Musk put $140M of his own money from the sale of PayPal into Tesla and SpaceX, and both nearly went bankrupt.

It is a true maxim that “Growth eats cash” because companies generally must spend way ahead of revenue to hire, train and build the infrastructure to manage people, market themselves and sell the products prior to collecting their revenue. This is why the stock market was created. It was designed to amass capital for innovative companies to grow and spread the risk in exchange for upside in share price over time. Although today more than 99% of stock transactions are “trading” not investing. If I were POTUS, I would try to get congress to put 100% tax on any capital gain on stock held less than 60 days, because day trading creates leaches on society that add no value. They are just people that suck off intelligent people from doing real productive work. They are just getting paid to watch a computer monitor and take other people’s money who are doing more productive things. However, that’s another post (rant). Warren Buffett invests, most people “trade”. That is why he is one of the greatest investors of all time.

Many companies invest heavily and seek professional venture capital early in years one to five or more because their window to grab market share is limited and it is worth giving up 50% or more of the company equity to build a $100M company instead of a $5M company on cash-flow. You have to run the numbers to decide. That is still 10X more wealth created for the founders! Would you like to own a whole grape, or half a watermelon? In those early years, competitors and copycats can grab lots of market share and erode your potential competitive advantage(s), economies of scale and maybe even do a better job than you and put you out of business. Every startup has many risks. Known and unknown. Therefore, raising capital usually makes sense for the typical startup that has some limited window of opportunity to launch and grow. It also allows for many surprises and changes which require “Pivots” in business model, strategy, marketing, or product. See my blog and free video on raising capital also because there are thirty other cheaper sources of capital than professional venture capital funds.

Most people fail to understand how hard it is to start and grow a company. The fact is that around 80% of startups (even when VCs invest $5M+) will fail eventually. Only 1 in 400 companies ever reach $10M in sales, and 1 in 6,300 will ever reach $100M in sales. That is like winning an Oscar, climbing Mount Everest or even winning the lottery. Few will ever reach that pinnacle. Though it is often mostly based on the collective skills of the team there is also a lot of luck involved in getting to these heights. Macroeconomic factors kill companies all the time too. I have taken two startups to $100M and $156M in 5 years each, statistically speaking the odds of one person doing that are 6,300 X 6,300, or 1 in 39.7 million. I am not that lucky for sure, but I do work hard, work smart and understand how to build a quality team and innovate. Think of it like this: You can build a tiny house alone, but not a skyscraper. That requires lots of people and materials.

Anyone that has to ask this question has years of learning and preparation to grow their skills in strategy, management, operations, hiring, some technical domain or industry. I read at least six books per month for 8+ years before founding my first serious startup, and had 5 years’ experience hiring and managing people. That is a bare minimum in my opinion.

If this all sounds complicated it is. You are competing with the top people in any industry and only a few companies can be very successful. People with more experience will win the investment capital, which can become a self-fulfilling prophecy of success. Most will barely survive. It takes years to develop the skills and also a serious management team to do all these things well. And very experienced managers will not work for people without lots of experience too. You need a good mindset, a top strategy, a top team and a unique business model to grow a large company. Which is why only 1 in 6,300 will ever reach $100M in sales. Most will ignore this advice and go sideways or up and down for many years.

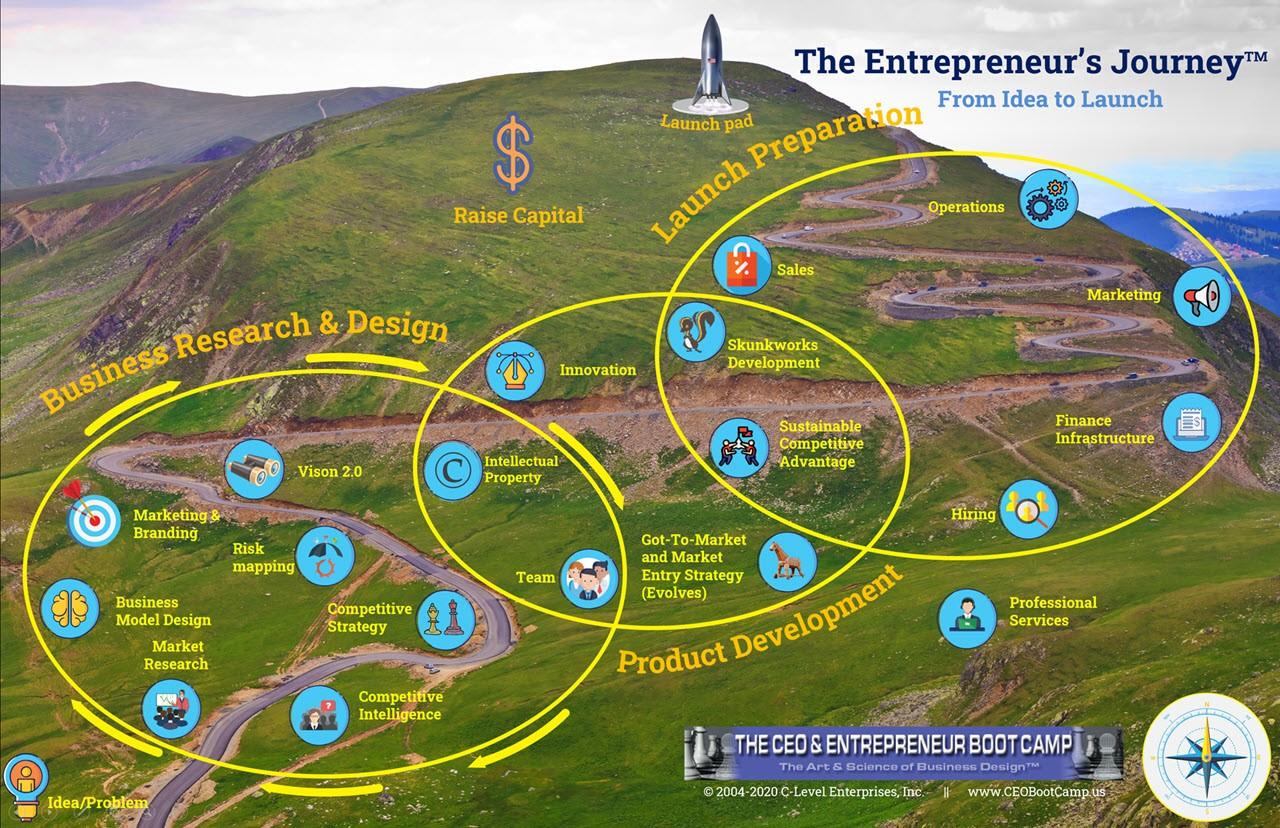

You can see a free video on the skills a team needs (never in one person)

to grow a startup to be a substantial company by clicking the image here:

We have trained management teams, entrepreneurs and CEOs since 2004 in all these forty skills and offer online certifications like Professional Manager Certification (PMC™), Growth and Scaling Professional (GSP™) and our intensive CEO Boot Camp since 2004. If you download my ebook below, you will also get access to my newsletter, blog and other resources for serious entrepreneurs. Entrepreneurship is not for everyone, but the rewards can be huge in many ways

You can also download my free eBook on the Top 8 Reasons Companies Fail to Raise Capital here: https://www.ceobootcamp.us/top8

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has trained, coached and advised over 1,000 CEOs since 2002. And is Founder of The CEO Boot Camp™ and Entrepreneurship University™. Mr. Norton works with companies to triple their chances of success in launching new companies and products. He helps established companies scale faster using the six AirTight Management™ systems. And helps companies raise capital.

What can we help you with today? Scaling, training, consulting, coaching?

Call (619) SCALE06 or (619) 722-5306 9am-6pm CT

Or Schedule a free 30-minute strategy session by clicking here.