New report shows entrepreneurship's partial return to pre-pandemic level

Report Highlights

- Nationally, the rate of new entrepreneurs in 2021 was 0.36 percent, meaning that an average of 360 out of every 100,000 adults became new entrepreneurs in a given month. The monthly rate increased substantially from 2019 to 2020 as the economy went through the shutdowns, job losses, and re-openings that characterized the early stages of the COVID-19 pandemic, and has only partly returned to pre-pandemic levels.

- The opportunity share of new entrepreneurs rebounded substantially to 80.9 percent from its low of 69.8 percent in 2020, but remained much lower than its pre-pandemic level of 86.9 percent in 2019. The decline from 2019 to 2020 during the first year of the pandemic was 17.1 percentage points, which is much larger than the one-year decline of 6.9 percentage points from 2008 to 2009 during the Great Recession.

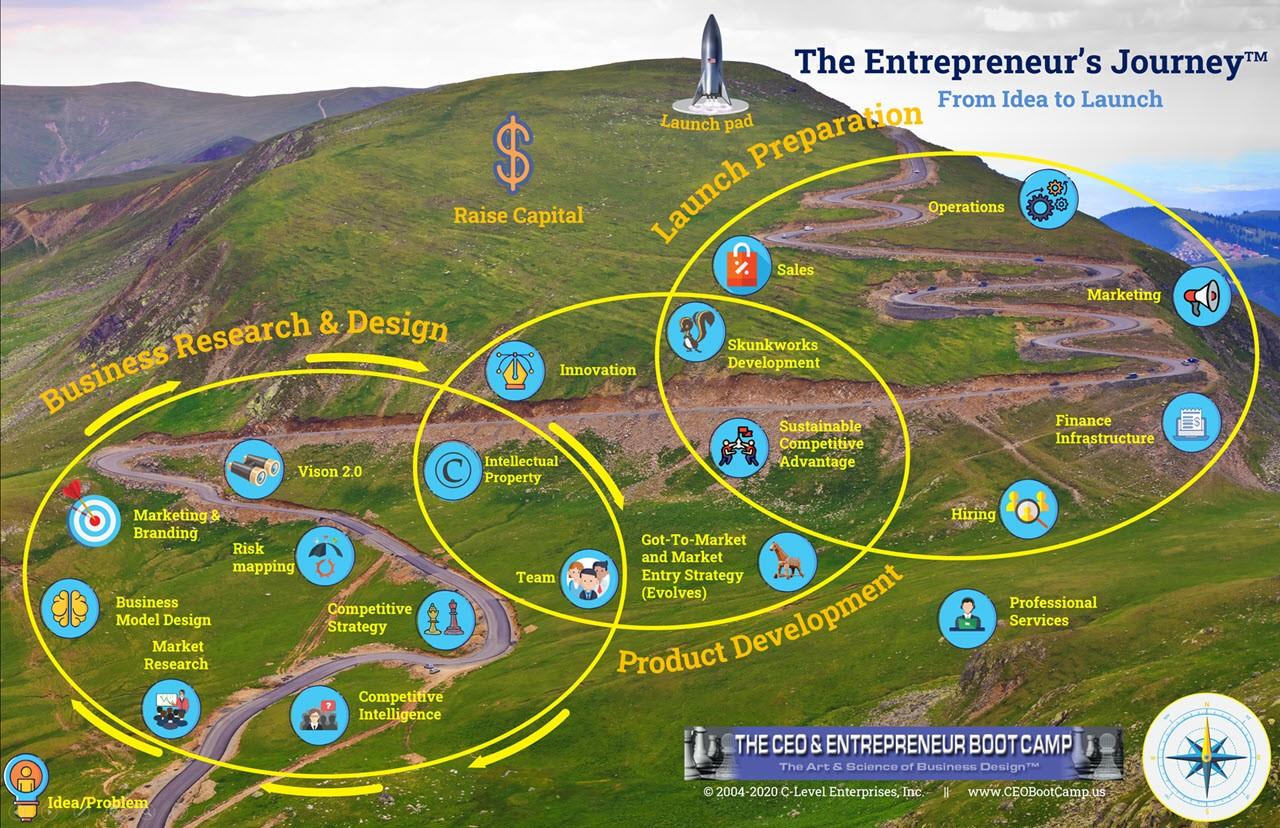

There is a free video course on this page explaining this Entrepreneurial Journey.

- Startup early job creation in 2021...

What are some common misconceptions people have about raising capital?

1. Thinking it is easy. It will typically take 3–6 months of full-time effort. 80% will fail.

2. That the “Idea” is worth something. It is not worth $0 because anyone can copy an idea and do better at marketing, sales, product development or just dump capital on that idea

3. Thinking VCs are the best source, they are the worst for 90% of businesses. They finance at most 1 in 200 plans and represent a tiny percentage of business financing. A narrow niche of rapid growth, technology based companies mainly.

4. A company has value on day #1. It does not! Value and pre-money valuation come from team + plan + market research + product development. Investors generally put money in only AFTER value is created.

| Learn more about our Growth and Scaling (GSP) |

| For a free video consultation call on what your |

The pitch deck...