What causes valuation change from one round to another for startups?

Valuation increase is all about reduction in the risk by achieving new milestones. Any startup worth outside investment has risks because it is doing something new, driven by innovation. If it is not new (differentiated in the market) it cannot demand the high gross margins needed to grow rapidly and pay investors the high return needed for that risk. Each risk that is removed by proving metrics around it is eliminated from the list and bumps the valuation significantly, sometimes by 2X or 3X even. This can mean millions more cash in a financing round and millions more net worth for the Founders and investors too.

Although the risks can vary, most are pretty generic for early-stage startups. Here are the top ones to think about and set as goals, timed with your financing timeline:

1. Team - Attract a top team of seasoned executives in innovation, marketing and sales. Finance and operations are less critical early on and have more generic skills, as they need less creativity and can be recruited from most industries. This assumes there is already an experienced CEO as a founder. Usually funded by the founder's initial investment and “Friends and family” money, plus lots of sweat equity, with the founders often working for equity only for 6 to 12 months. This is bootstrapping, but most companies require outside capital eventually. Only very small companies and service companies can generally be bootstrapped all the way to profitability.

2. Prototype/MVP - Build the product to be the best for a given target market (niche). Often called a Minimum Viable Product by The Lean Startup, a book every entrepreneur should read. A seed round where the company is worth very little, maybe $500K to $2M, but could be $5M, $10M or more with a top management team that has previous successful exits. Often an angel investment round is $500K to $2M, but it depends on many factors.

3. Soft launch or Pilot - Pilot the product to get user feedback and validate the results promised, i.e. cost savings, additional revenue, strategic advantage. And design the final “Version 1.0” for a larger launch with marketing and sales investment. Could be achieved with previous round or require a new round from angels. This is often called "traction" and it means 20+ paying customers in large ticket sales and many thousands of users for an online or app venture.

4. Marketing Metrics Proven, Cost per lead - Build the marketing process to generate leads cost effectively.

5. Sales process proven - Build the sales process to close those leads and win a high percentage of deals that is profitable based on the lead acquisition cost, gross margins, and other factors. This does not mean the CEO or a VP sold a few. It means you can hire a salesperson at a reasonable wage, and they can sell. Usually, the senior management must figure out the target market and sales process, this is not what salespeople are good at. Though often this can be copied from similar companies to some degree. This can take some companies years but the better the product (read more differentiated and value) the easier all this is. Tesla spends little on sales and marketing because they have had the best product in EVs for many years.

6. Operations infrastructure and procedures in place - Begin staffing operations, which can mean designing, documenting and training about 20 to 30 processes internally to prepare to acquire lots of customers and refine all internal operations. Several key processes are needed in each department, especially customer service at this stage, to provide a pleasant customer experience that will generate good references, brand vibes and word-of-mouth. This is often when a company seeks a “Series A” investment from venture capitalists, family offices or angel syndicates that can invest $2M to $10M+.

Click here to check our all Certification Programs

7. Management Systems in place - Install the management systems and other infrastructure required to scale a company at 50% growth annually, that includes policies, processes, procedures, and a culture that is highly productive. This includes strategic plan, dashboards/KPIs, process management and optimization, annual budgeting, and human resources. These are the systems I specialize in and install for clients using a standard system to start and then some customizing to the company's needs. Only 1 in 400 companies will ever reach $10M in sales, and one in 6,300 companies will reach $100M in revenue. This $100M is the minimum revenue goal for institutional investors five years out. This is needed to make up for the high risk and capital to get over all the above risk hurdles. This level of revenue also allows a company to go public or be acquired for an exit.

Achieving each of these milestones can double or triple a company’s valuation to raise capital, or more. So, if you start at a $1M valuation for the team and plans you should around double each time you eliminate a risk and (assuming a large market) you can hit $1M X 2 X 2 X 2 X 2 X 2 X 2 = $128M valuation. $1M X 3 to the power of seven is $2.18 billion. A "unicorn". Called that because they are very, very rare.

As the risk is plummeting with each achievement and the calculated return for investors is skyrocketing. The more seed money and sweat equity the founders can put in (longer bootstrapping), the higher up this exponential valuation curve the company gets before seeking outside investors. And the more wealth the founders will generate for themselves and the other employees with stock options, instead of all the gains going to investors. Very high capital needs often mean less wealth for the founders. The founders that got very rich bootstrapped a long time or put in lots of their own money early. Musk, Dell, Branson, Jobs, etc. Often, they built the entire MVP product on their own sweat and cash.

A CEO can end up with 1%, 5% or 50% of a company by IPO/exit depending on how quickly they figure all these things out and how much money it takes. Each new round of investment dilutes the previous owners, but if there is a large increase in valuation because new milestones have been hit, then the dilution tapers off. This makes it possible to raise increasingly larger rounds of funding without diluting the founders down as much.

A company can achieve “Unicorn” status of $1 billion if their market is big enough, and they have enough of a lead to grab lots of market share before competitors can replicate their product/service. This is why having intellectual property (IP) in the form of patents, trademarks, copyrights and trade secrets is critical. This IP creates barriers to entry for competitors and gives them more time to gain market share and scale before competitors enter the same market. Every company should have IP, even if it is just internal copyrights and trade secrets in processes. There are many kinds of IP and other barriers to entry that people rarely consider. See my course on IP here. Smart startups have literally zero competitors in the first few years because they target smaller niches to enter the market initially and build high barriers to entry while they are in stealth mode. You do not want to go after huge markets where 800-pound gorillas reside until you reach stability.

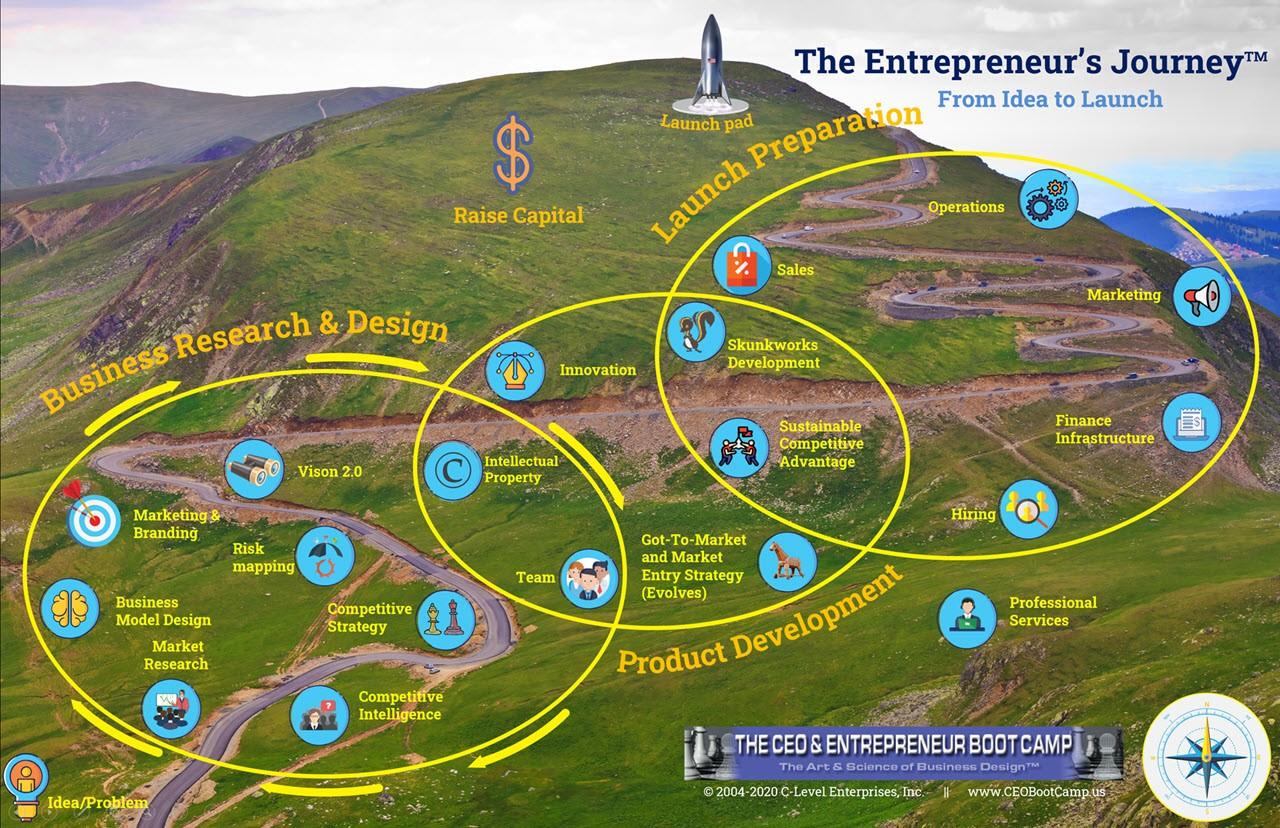

You can see my free video course on the Journey Entrepreneurs must make, broken down into the 30 to 40 skills and tasks they must achieve to climb this mountain that few will reach the top of here:

Less than 1% of companies will qualify to successfully close professional venture capital money, though there are many other sources of funding. Get my free e-book on The Top 8 Reasons Companies to Raise Funding here: https://www.ceobootcamp.us/top8

Every founder needs a CEO Coach and several mentors in different areas to achieve success. You will never see a top athlete without a coach. And you must build your skills and read, read, read to prepare for years before founding a company. No one should found a startup without 8 to 15 years professional experience first. They must know the arts of hiring, management, marketing and innovation, or at least how to manage these areas to succeed. I prepared for eight years, really 16 if you include the time and businesses I ran in high school, including a mail order company for ham radio antennas. And I read four to six business books a month for a decade, too. Building a significant company is a daunting process. Best to set out with the rights skills and equipment. Like climbing Mount Everest, you will fail without help.

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has trained, coached and advised over 1,000 CEOs since 2002. And is Founder of The CEO Boot Camp™ and Entrepreneurship University™. Mr. Norton works with companies to triple their chances of success in launching new companies and products. He helps established companies scale faster using the six AirTight Management™ systems. And helps companies raise capital.

What can we help you with today? Scaling, training, consulting, coaching?

Call (619) SCALE06 or (619) 722-5306 9am-6pm CT

Or Schedule a free 30-minute strategy session by clicking here.