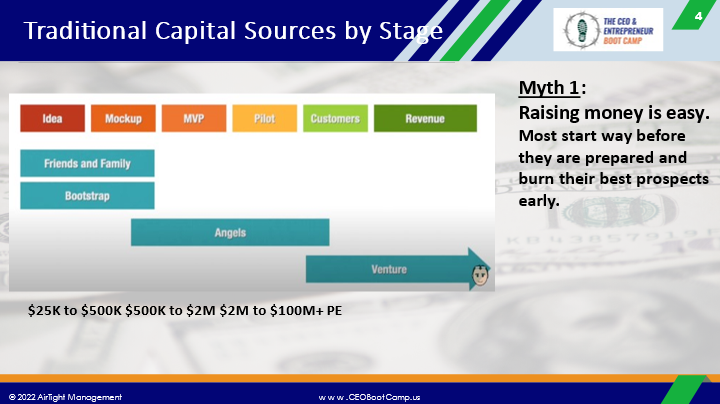

How much capital can a company raise at each stage of its development?

These stages have evolved over time and the ranges are somewhat elastic, mainly based on the quality of the team involved. If you have three top people with 15+ years’ experience and success each as CEO, Chief of Product Development and head of sales/marketing you may be able to get a pre-money valuation of $5M to $10M today with a quality deal. With just a founder and a business plan, your company is likely worth less than $500K. This assumes a $1B market potential, $100M+ revenue potential in five year (top 5% of all companies ever) and some nice progress on product development or actual revenue.

Do not try to do this alone. For that, we offer a flat rate package here. Or hourly consulting. Call (619) SCALE06 from 9am to 6pm CT.

Bootstrapping – This is where the founders are putting in sweat equity, and possibly a small amount of cash investment as well. Founders often bootstrap longer to keep more of their own companies by investing $50K...

Should you use a finder raising capital?

Absolutely not. These people are usually pretty much scammers. It is illegal for anyone, except SEC licensed brokers, to sell stock to other people. There is some gray area here, as they can make introductions, but these usually have no weight at all with investors. And they can never take a percentage of the stock or cash in the close for these “introductions”. Run, don’t walk from anyone seeking a percentage of funds closed to be your “finder” or “Consultant” to do introductions.

Click here to get this Financial Package

How to Raise Millions for Any Company - Online Video Course

| Learn more about our Growth and Scaling (GSP) |

| For a free video consultation call on what your |

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has trained, coached and advised over...

How do you find someone to help you raise capital?

Firstly, there are several categories of help, and some deserve the cost and effort while others do not.

Finders, people that claim they will introduce you to investors are generally just conman, or women. Rarely, if ever, do these people have any real influence or credibility. By definition, if they are getting paid something to do this, then they have lost all credibility by creating a conflict of interest. They have an instant conflict of interest. A “warm referral” is free because the person knows enough to be confident in you and your pitch, at least enough not to embarrass them – which frankly most pitches would do because they are so poorly crafted.

Investment Bankers typically are interested when you wish to raise $5M+. Some have no interest until you are seeking $20M or more. This means you are already an established company with revenues, a quality team and a proven product already. Typically, some profits too. So, this is...

Build the company of your dreams and Raise Millions from Outside Investors

This $1,695 package includes four private online sessions with me working on your financing, and the offline work needed to review and edit your deck. It will greatly improve your BUSINESS, not just your deck. You will be "Level 5", or at least "angel ready" by the time we are done if you follow the guidance I give. This process usually takes 4-8 weeks, depending on your ability to focus on that work. Nothing worthwhile is easy.

And remember to not operate based on these common myths of financing:

1. Your idea alone is worth millions. NOPE! Pre-money valuation is only created when you put a team, plan and some value behind it via sweat equity and/or cash invested to create value - Unless you are Elon Musk.

2. Raising funding is easy - Not! Over 80% who try will fail. You need some experience on your team that has done this before to guide you to shorten the process and avoid...

New report shows entrepreneurship's partial return to pre-pandemic level

Report Highlights

- Nationally, the rate of new entrepreneurs in 2021 was 0.36 percent, meaning that an average of 360 out of every 100,000 adults became new entrepreneurs in a given month. The monthly rate increased substantially from 2019 to 2020 as the economy went through the shutdowns, job losses, and re-openings that characterized the early stages of the COVID-19 pandemic, and has only partly returned to pre-pandemic levels.

- The opportunity share of new entrepreneurs rebounded substantially to 80.9 percent from its low of 69.8 percent in 2020, but remained much lower than its pre-pandemic level of 86.9 percent in 2019. The decline from 2019 to 2020 during the first year of the pandemic was 17.1 percentage points, which is much larger than the one-year decline of 6.9 percentage points from 2008 to 2009 during the Great Recession.

There is a free video course on this page explaining this Entrepreneurial Journey.

- Startup early job creation in 2021...

What are options to raise venture capital?

You create value by doing the following before even calling a VC:

- Build a team of 2–3 committed founders with 10+ years' experience each.

- Develop a business plan, based on in-depth market research and competitive intelligence which covers your strategy for marketing, sales, operations, finance and product development (pure service companies rarely get VC money because the margins and competitive advantage is harder to justify the ROI these investors need).

- You develop a product that can be protected via intellectual property or other methods to create and maintain some “Sustainable Competitive Advantage” (SCA). First to market is SCA if there is a “Network effect” whereby you can maintain a lead through customer critical mass (i.e. Facebook/Meta)

- Ideally, finish a product and get some “Traction” which means customers paying. Angel investors may not need this, but most institutional investors will need this “Proof of concept”....

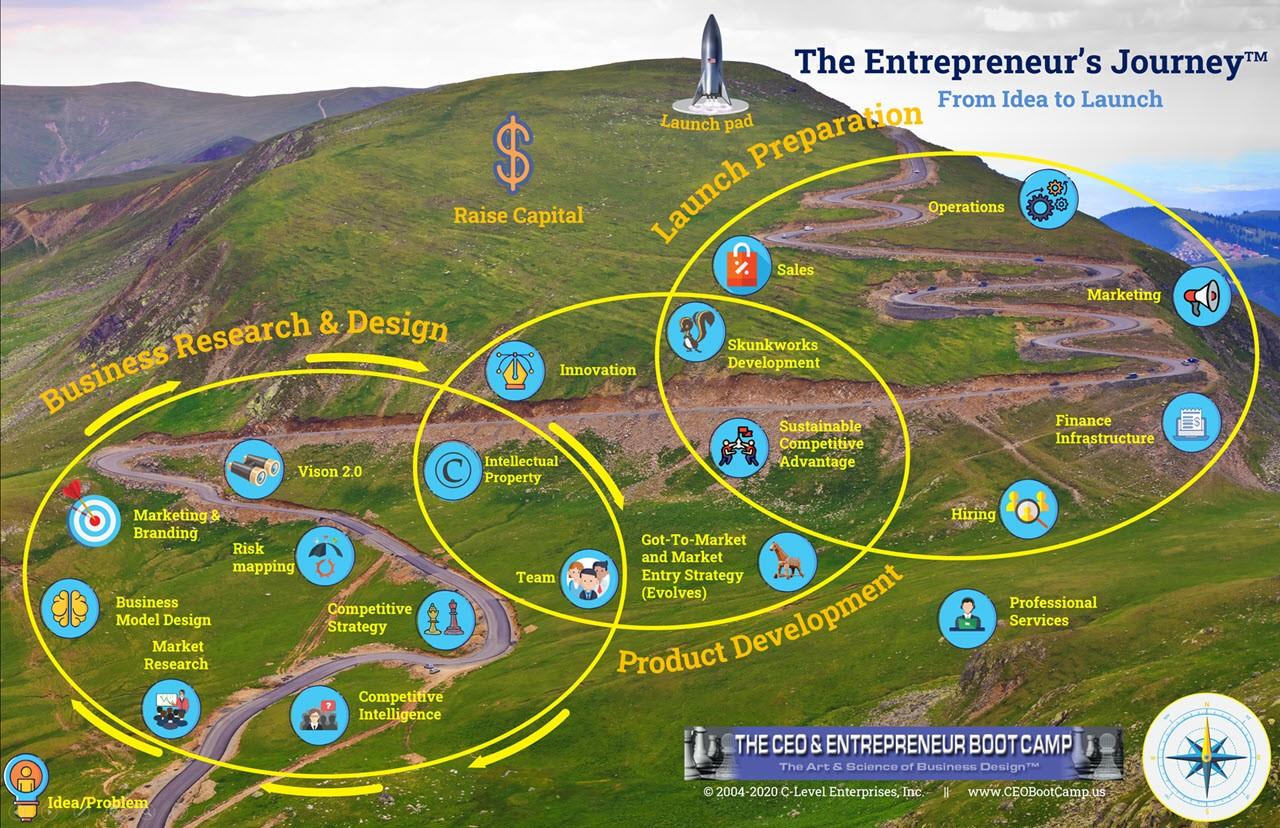

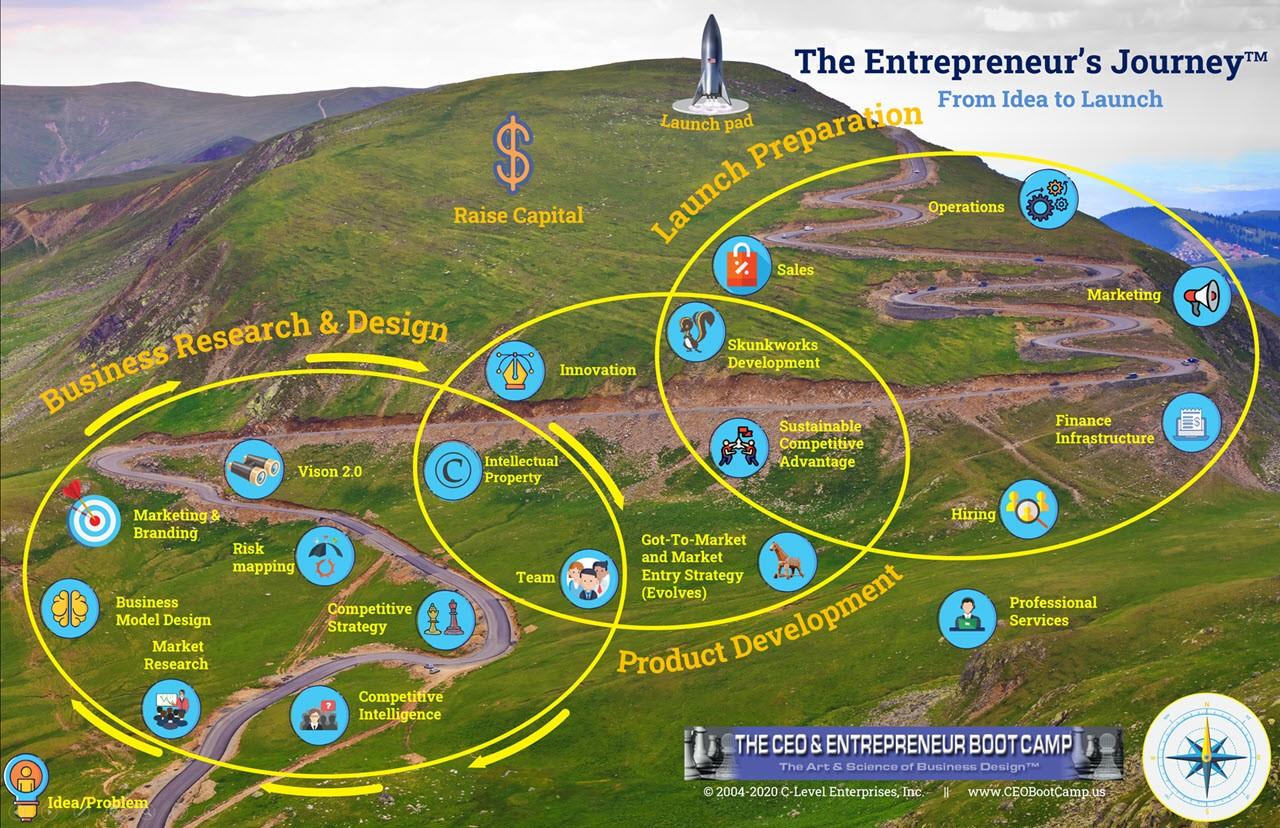

What is the entrepreneurial process of creating a new venture?

There are different processes, but the one we teach at The CEO Boot Camp that can almost guarantee success of a new company or product is shown here:

There is a free video course on this page explaining this Entrepreneurial Journey.

How to Raise Millions for Any Company - Online Video Course

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has trained, coached and advised over 1,000 CEOs since 2002. And is Founder of The CEO Boot Camp™ and Entrepreneurship University™. Mr. Norton works with companies to triple their chances of success in launching new companies and products. And helps established companies scale faster using the six AirTight Management™ systems. And helps companies successfully raise capital.

Call (619) SCALE06 or email [email protected] for a complementary strategic consultation.

Where can I view data on startup valuations and funding rounds?

Raising funding is a complex process that few understands as they are often doing it for the first time. I would say about 90% of people I see present to angels just “don’t get it”. They do not understand what outside investors need to see to invest. The course above gives the foundational fundamentals that ALL investors want to see.

Developing a company that has a higher valuation can be the difference between owning < 15% (average exit ownership of founders) and 50%+ like Mike Dell, Bill Gates and Elon Musk. Bootstrapping, friends and family investment, then angels is the classic path, but there are over 40 other categories of investment funds that can be tapped into which represent more than 100X what VCs and angels invest.

| Learn more about our Growth and Scaling (GSP) |

| For a free video consultation call on what your |

Pitch book just released a full report on...

Everyone Wants to Be an Entrepreneur

By Arielle Pardes

Applications for new businesses rose 20 percent last year, after languishing for a decade. Many newly minted founders attribute it to the pandemic.

ANGELA MUHWEZI-HALL HAD a startup idea long before the pandemic—it just never seemed like the right time. She had a steady job at a university, a 401(k), and the ability to take paid time off. Then came March 2020. As the university shut down and Muhwezi-Hall retreated to work from home, she started to think about making the leap.

What she wanted to build was a job platform for service workers. While the idea was old, the timing was suddenly perfect: Millions of service workers had just been laid off and were looking for new jobs. She recruited her sister, Deborah Gladney, to help build a prototype. By August, the sisters had quit their full-time jobs to work on the startup, QuickHire.

Muhwezi-Hall and Gladney are part of a rising tide of first-time entrepreneurs. In 2021, more than 5.4 million applications...

Why do Most Start Ups Fail?

I wrote an eBook to answer this exact question, title The Top 20 Reasons Startups Fail and How to Avoid Them. It is based on some research. You can download it free here: top20

I have also created a 3-part video course here reviewing this question from the perspective of what learning and tools are required to avoid these twenty mistakes called The Entrepreneur's Journey here.

Join Live Webinar on 12th April 2022

Bob Norton is a long-time Serial Entrepreneur and CEO with four exits that returned over $1 billion to investors. He has trained, coached and advised over 1,000 CEOs since 2002. And is Founder of The CEO Boot Camp™ and Entrepreneurship University™. Mr. Norton works with companies to triple their chances of success in launching new companies and products. And helps established companies scale faster using the six AirTight Management™ systems. And helps companies successfully raise capital.

Call (619) SCALE06 or email...