What are Some Ways for Startups to Invest in Marketing with Little Cash?

You cannot grow a company without some investment in sales and/or marketing. The question is really your time versus capital and which would generate the best results (ROI, speed, quality of leads, etc.). If your business model and products are sound, you should likely raise some capital, as it will be needed for more than marketing. It is nearly impossible to build a significant business without some capital and/or sweat equity invested. You cannot create something out of nothing.

Social media allows unpaid marketing and is the most obvious strategy. This can be time-consuming but is also rapid to measure and so can be used to test the messaging and refine it quickly.

The more unique your product or service, the smaller the marketing budget you will need. For example, Tesla spends extremely little compared to other automakers on both marketing and sales. Word of mouth does it for you when you have strong and unique products. “Differentiation”...

What causes valuation change from one round to another for startups?

Valuation increase is all about reduction in the risk by achieving new milestones. Any startup worth outside investment has risks because it is doing something new, driven by innovation. If it is not new (differentiated in the market) it cannot demand the high gross margins needed to grow rapidly and pay investors the high return needed for that risk. Each risk that is removed by proving metrics around it is eliminated from the list and bumps the valuation significantly, sometimes by 2X or 3X even. This can mean millions more cash in a financing round and millions more net worth for the Founders and investors too.

Although the risks can vary, most are pretty generic for early-stage startups. Here are the top ones to think about and set as goals, timed with your financing timeline:

1. Team - Attract a top team of seasoned executives in innovation, marketing and sales. Finance and operations are less critical early on and have more generic skills, as they need less...

The Clash in Styles at Twitter is a Master Class in Management and Organizational Change

The clash at Twitter is a master class in management styles and a case study in what works and does not work, as well as radical organizational change. As Elon Musk's hard driving style is injected into Twitter's Millennial/woke/snowflake culture, explosive results must be expected. The two extremes in style and the rush to convert one culture into the other has created a circus to watch that has many lessons for all, including Elon. Elon's Asperger's Syndrome prevents him from understanding the needs of the people in the transition - though clearly many cannot make this transition too.

Here is a diagram of "The Science of Management" that shows a valuable high-level cadence to bring structure to management. Our framework of 6 systems creates a "closed system" that is constantly improving, incorporating the proven ideas and principles curated from over 1,000 books I have read over 30+ years. See www.AirTightMgt.com.

One problem with the art of management is that it is not...

Do All Startups Bleed Money and Does Scaling Always Require Outside Investors?

This was a question from a prospective Entrepreneur. Maybe one that believes that he/she can create a company without any outside investors.

Well, whenever you use the word “All” in a sentence you are almost always wrong, but it is true that the vast majority of startups and any company wishing to grow rapidly (scale) will require either outside investors, founder capital investment and/or sweat equity (founders working long-term for only equity).

This is because you cannot create something out of nothing. Like in physics, matter cannot be created or destroyed, it only changes form. Cash investment must be converted into value in the form of a product or service people will pay for, and the must be willing to pay more than the cost to deliver it. Generating a "Gross margin". Usually this needs to be 50% or more to pay staff and other overhead costs, though high-volume stores like groceries often operate on 20% gross margin.

First, let’s...

Scale Sooner and Perform Better - AirTight Management An interview with Go Solo

Scale Sooner and Perform Better - AirTight Management

An interview with Go Solo

This interview speaks to what is needed is to begin scaling and targeting companies that have some product market fit and are ready to begin growing.

What's your business, and who are your customers?

We help businesses with 5 to 200 employees scale their business by installing all the systems needed for strategy, management, metrics, process improvement, budgeting, and human capital.

Tell us about yourself Bob

As a serial entrepreneur for 14 years, I built and sold four different companies, returning 25x ROI to my investors and over $1 billion in profits.

What's your biggest accomplishment as a business owner?

Disrupting the real estate industry by creating the first high-definition, remote touring for residential real estate. Also disrupted financial services with five different products and created The CEO Boot Camp (2004), where we have trained thousands of CEOs and entrepreneurs in best...

What are the most common mistakes you have seen founders make when they start a business?

Prepare for years in advance by study and experience in management, leadership and smaller companies. Read 2–4 books per month. Always be learning. Now, you can build a tiny house alone, but building a significant company requires a team without about 20 different skills that no one person possesses. Many think they can build a skyscraper alone, even without capital! Dumb. A formula for disaster and why 85% of new companies fail. It takes tremendous commitment and perseverance and is always a rollercoaster ride. Almost never a straight, predictable, linear process.

Here are some great educational sources I have created to solve this exact problem click here to check

Click here to check our all Certification Programs

All entrepreneurs and CEO must be committed to life-long learning. After 31 years as a CEO it gets hard to find and learn new things, but the world changes and there is always something new to learn. Most success comes from great strategy and great team....

Is it the VC that proposes the amount for the pre-seed startup or it is the CEO that claims what amount is needed?

No good investors would want to invest in a company where the CEO did not have their head around the capital needed. A financial projections and plan is required to even get a meeting with most investors. That said, there can always be some back and forth negotiations. A VC might want to put more money in to scale faster. A CEO wants minimum dilution and to get the valuation up by achieving key milestones like MVP, traction, team building and quantification of customer acquisition costs. All of these reduce risk and hence increase the share and valuation price.

Click here to check our all Certification Programs

Pre-seed means smaller amounts and lower valuations because the risks are high. Contrary to popular belie, very few VCs do these stage deals, unless it is a team that has made lots of money for investors before. Typically, these rounds are $250,000 to $500,000 and done by angel investors.

You can see my free webinar on preparing your company to raise...

Should I join a company as a Founder?

If you have to ask this question, you are likely not passionate enough or ready in other ways to do this. The commitment to any startup is likely five or more years. And long working hours that can easily be sixty-to-eighty-hour weeks at times. As a result, you need to know for certain you would both enjoy the work and are qualified to do the job offered. You also need to do your due diligence to understand the company’s team, finances and chances of success. About 85% of startups will fail. Just a fact.

Asking about a specific company is almost not relevant because the decision process for you is the same and we (advisers here) do not know your background or private information about the company. Nor did you say if this was a promotion, good salary, equity offer, no pay, or whatever. All 100% relevant to any answer.

My main career advice to people is, “Always be learning”. By increasing your knowledge and experience, your market value and options will go up....

Is crowdfunding on Kickstarter and Indiegogo an effective financial strategy for startups?

Crowdfunding has a place, and I am excited about its growth possibilities in certain areas. The funding raised has been about doubling each year for some time now.

It is generally for consumer-oriented companies where the vote of the consumer matters. This is a test of the product demand as well as a way to raise funding for a production run of an early version.

Recently the amount that could be raised was increased to $20 million via crowdfunding and the amount of fraud has been low. Of course, the average consumer does not have the skills to evaluate a company, team, market opportunity, and strategy well. And this takes real work. So essentially, they are just betting on the product concept. And since the amount of money raised is generally small (~$100K-$250K) it is enough to replace the traditional “Friends and family” money when the founders have no wealthy family or past success to roll their gains into the next business.

Of course, even professional venture...

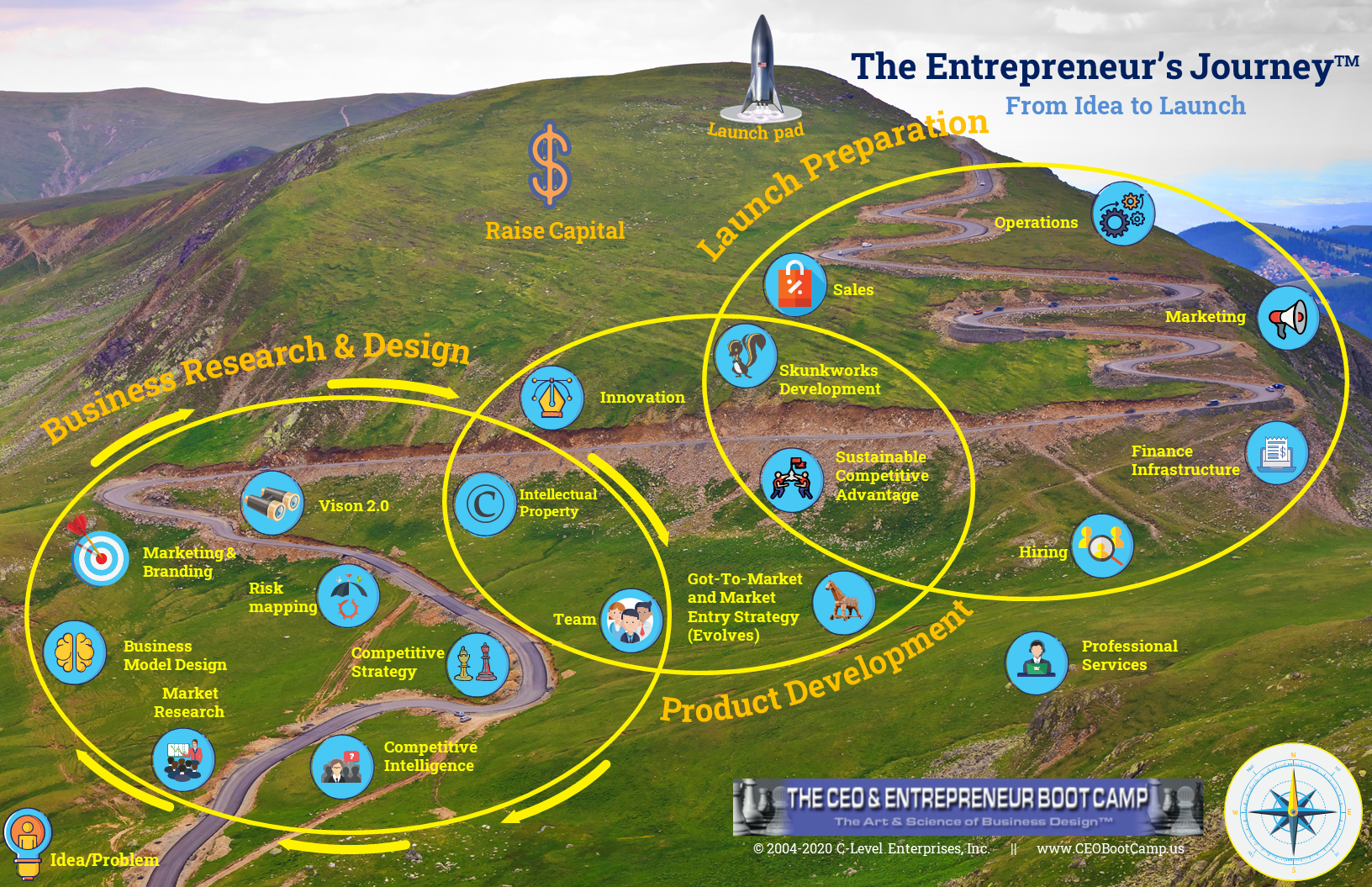

What Different Functions are Essential to Manage an Entrepreneurial Venture?

There are five key areas in most business plus the softer skills of management, leadership, hiring and creating a productive culture. The five key areas are:

- Marketing

- Sales

- Product/service development (innovation)

- Finance

- Operations & Customer service

A new venture needs slices of expertise in each area with a senior person that has 5+ years full-time experience in each on tap. Initially the development of the company is mainly about #1 and #3, which Peter Drucker the father of management says are really the two key functions. This is true because they require more creativity and top people.

In addition, under these categories of business there are about 30 to 40 more detailed level skills needed to grow any company. For example, marketing would include: branding, strategy, graphics design, SEO, PPC, copywriting, web page programming, etc.

I created a course to review these skills that is about one hour and free here:

This is about growing significant businesses and building...